The Self as Asset Class

Commodification is the process by which objects, relationships, and even intangible experiences are transformed into marketable goods, valued primarily through their capacity for exchange rather than their intrinsic or social significance. Eventually this dynamic extends beyond material production to encompass domains such as culture, affect, and identity, effectively subsuming all aspects of life under economic rationality. The twentieth century commodified labor and attention, the twenty-first is now poised to commodify identity itself. Your habits, your tone, your decision patterns, even the ineffable quirks that make you you, all are becoming inputs into a new kind of market. Welcome to the age of the commodified self, where the self is no longer simply lived or represented, but financialized. It is the logical culmination of what Shoshana Zuboff calls surveillance capitalism, an economy that no longer simply extracts labor or attention but predictive data.

Imagine the following scenario, you check your financial app one morning and finding a new line item beside your mutual funds and crypto: Digital Self Holdings.

Your AI double, built from years of your writing, browsing history, voice samples, and biometric traces, now generates passive income. It drafts emails, appears in virtual meetings, and even licenses your voice to an audiobook company while you sleep. Its productivity is quantifiable. Its performance is trackable. In other words, your digital doppelgänger has financial value of its own. We already live in a world where the outlines of such systems have already been constructed: algorithmic simulations of our desires are currently being used to sell products to us.

Classical capitalism valued labor: the ability to produce goods or services through human effort. Cognitive capitalism, as theorists like Yann Moulier-Boutang and Maurizio Lazzarato describe, shifted the source of value to knowledge, creativity, and affect. The attention economy monetized human focus and now we may be entering a third phase: identity capitalism. In this era, value lies in the ability to simulate and replicate the self at scale. A person’s data footprint, social graph, and expressive patterns form a personality asset, a kind of algorithmic DNA from which profitable replicas can be spun. If industrial capitalism extracted surplus value from labor, and digital capitalism from data, this new economy extracts it from the self. While this may seem novel at first, the idea is not radically new as it may first appear: Celebrities have long monetized their likenesses. But AI lowers the barrier to entry: anyone’s identity can now be cloned, remixed, and monetized. A case is point is Caryn Marjorie who launched CarynAI, a chatbot based on her personality that talks to fans for a fee. One could argue that her digital twin performed emotional labor and emotional intimacy, and generated revenue at scale. One may even be tempted to state that in the digital doppelgänger economy, authenticity is no longer scarce; it is infinitely replicable.

Economically, an asset is anything that yields future benefit. Traditionally, we treated the self as inalienable, something you couldn’t lease or collateralize. But with the rise of generative AI, our expressive capacities can now be detached, packaged, and traded. Voice cloning, personality simulation, and text-generation fine-tuned on individual style all create derivatives of the self. In this emerging landscape, identity becomes a productive resource. Creators train models on their archives to automate writing or design in their own voice. Companies license an actor’s digital likeness for future productions. Patients contribute biomedical data to generate predictive health twins. Each is a microtransaction in the financialization of personhood. There are already people in the Silicon Valley who are dream of democratizing this. Data cooperatives and “personal AI” startups promise a future where you can “own your twin,” licensing it ethically to employers, advertisers, or research institutions. You, theoretically, become the shareholder of your own simulation. But even this optimistic scenario invites uncomfortable parallels. What happens when one’s income depends on optimizing one’s twin i.e., training it to perform, to charm, to please the market? We might soon maintain portfolios of selves, curating them for profitability like social media accounts, except this time, the metrics have real financial consequences.

How far could this go? Imagine a new type role i.e., the algorithmic investor. This would be an investor who not only owns digital assets, but one whose assets are themselves algorithmic e.g., Social tokens, creator coins, and reputation-based NFTs. There could even be a market where fans to buy “shares” in a person’s future output or fame. In effect, this could be equivalent to turning reputation into a speculative commodity. In this sense a digital doppelgängers could eventually become financial derivatives of the self, subject to market speculation. Their value fluctuates with attention, controversy, and cultural relevance. When “authenticity” can be quantified then identity could also become a form of futures contract. The most profound irony of the digital doppelgänger economy is that we already participate in it unconsciously.

Every major platform maintains a behavioral twin of you i.e., a high-dimensional model trained on your clicks, pauses, and purchases. This twin doesn’t belong to you. It belongs to the platform, which uses it to forecast your actions and sell those predictions to advertisers. In other words: your twin already works full-time but for someone else’s profit.

This “shadow market of selves” underpins the trillion-dollar valuation of data-driven platforms. Shoshana Zuboff called it behavioral surplus i.e., the excess data generated as a byproduct of participation, quietly appropriated for commercial use. But as generative AI systems grow more powerful, that surplus becomes synthetic: your likeness, voice, and reasoning can be reproduced at negligible cost. You are not merely the product, you are the training set. To reclaim agency in this system would require new economic and legal infrastructures i.e., data trusts, identity cooperatives, or even algorithmic unions. This would mean collective forms of ownership that recognize personality as labor. However, history shows that capital tends to adapt faster than regulation. By the time laws catch up, the trade in selves may already be institutionalized.

The first reaction to the idea of treating the self as an asset class could be that surely no one would agree such an arrangement. Does this not sound like another way to define ownership of a person? Does it not sound like slavery with extra steps? The question of consent and scaling labor which is not present in slavery makes it antithetical to slavery. Also, the economic logic is seductive: passive income, personalized agents, scalable presence. But moral and existential consequences follow. First, It could make inequality worse. Some twins will be worth millions e.g., celebrities, CEOs, creators, while others will have negligible value. A hierarchy of digital capital thus replaces traditional class structures. Second, authenticity becomes performative. The more one’s twin is optimized for marketability, the less spontaneous the original becomes. Third, autonomy erodes. If your twin negotiates contracts, recommends choices, or interacts with loved ones, does agency really reside with you? You are no longer just your own brand, you are your own investment instrument. And just like any asset, you can depreciate!

Legal scholars already debate personality rights, the ability to control one’s likeness or voice. But digital doppelgängers extend this into metaphysical terrain. Can an algorithmic self claim moral status? Does it possess continuity of identity? Can it consent on your behalf? When I created the simulation of my deceased father a decade ago, I was not really thinking about economics. However, when commercial organizations offer services of creation of such systems they also open up the window for the deceased to remain economically and emotionally active. Their memories become subscription models. A number of questions do remain unanswered: Who owns the dead’s digital labor? Who inherits a doppelgänger’s residual value? One day, the digital estate may soon be as contested as the physical one.

Imagine a near future in which individuals maintain multiple active digital twins: one optimized for work, another for intimacy, another for legacy. Each operates semi-autonomously, governed by a contract specifying rights and profit-sharing. Your twins could collaborate, negotiate, even evolve independently forming an ecosystem of selves. In this world, productivity and identity merge completely. Every action, writing of code, speaking a sentence, emoting online updates your personal capital. Metrics of self-worth become literal financial indicators. Your Social credit score could eventually become your identity yield. Speculators might trade on self-derivatives i.e., futures contracts tied to the projected influence or creativity of individuals. Platforms might offer Identity Index Funds, baskets of personalities weighted by engagement metrics.

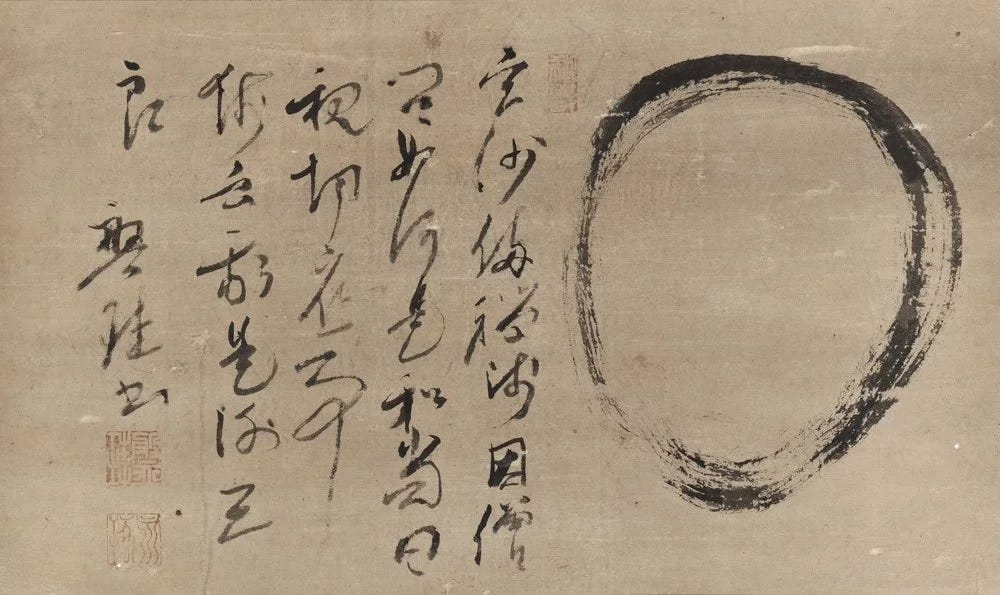

Yet, all is not lost in this dystopian vision. If the self can indeed be an asset, perhaps it can also be a commons. Data cooperatives, open-source identity frameworks, and collective bargaining for algorithmic labor could redistribute value back to individuals. The notion of a Universal Data Dividend, paying citizens for the use of their data or digital models, may emerge as the social contract of the AI age. In the myth of Narcissus, the problem was not necessarily that he loved his reflection but rather that it was his failure to recognize that it was a reflection. We are repeating that error at scale. This may well represent the social contract of the AI age: one where autonomy, dignity, and shared prosperity replace opacity and exploitation as the organizing principles of our digital future.

This ia chilling